Updated Legislation

Updated Legislation

INTERSHORES| An Update On EU List Of Non-Cooperative Jurisdictions For Tax Purposes

The EU announced its review of non-cooperative jurisdictions for tax purposes in the year. As a recap, the updated blacklist includes 9 jurisdictions whilst grey list contains 25 jurisdictions. In this review, no jurisdictions were added to or removed from the blacklist. Bermuda and the BVI had been added to the grey list.

Bermuda has been added to the grey list as it has yet to address the issues identified by the OECD Forum on Harmful Tax Practices (FHTP) with respect to the implementation of the economic substance regime.

The BVI has yet to implement a recommendation made by the OECD Inclusive Framework on BEPS (IF) in relation to the implementation of the minimum...

Details

INTERSHORES | Hong Kong’s Foreign Source Income Exemption Regime For Passive Income Will Be Refined

European Union ("EU") expressed its concern over Hong Kong's foreign source income exemption (FSIE) regime which provides a tax exemption to a broad range of passive income without specific conditions and a substance requirement leading to double non-taxation of passive income booked in a Hong Kong shell company. As a response to their concerns, the Hong Kong Government has recently proposed a revised on FSIE regime. Under the proposal, Hong Kong will continue to adhere to the territorial source of principle of taxation.

1. However, Hong Kong constituent entities of a multinational enterprise (MNE) group, wherever headquartered and irrespective of group asset size and revenue,...

Details

INTERSHORES | Phase 2 of New Inspection Regime of the Companies Register Under the Companies Ordinance to be implemented on 24 October 2022

A New Inspection Regime of the Companies Register under the Companies Ordinance (“New Inspection Regime”) to be implemented in three (3) phases whereby personal information including the full identification numbers and usual residential addresses of directors, company secretaries and other relevant persons (“Protected Information”) will NOT be made available for public inspection was mandated under Companies Registry External Circular No. 1/2021 dated 16 Aug 2021. For the purpose of implementing Phase 2 (to be implemented on 24 Oct 2022) of the Regime relating to the withholding of Protected Information from the Companies Register maintained by...

Details

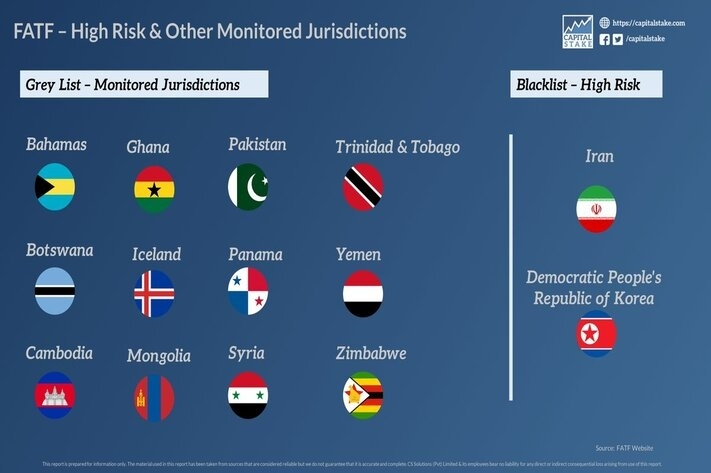

INTERSHORES l The Financial Action Task Force (“FATF”)’s Update On High Risk Jurisdictions and Jurisdictions Under Increased Monitoring

The Financial Action Task Force (“FATF”) , the global standard-setting body for anti-money laundering and combating the financing of terrorism (“AML/CFT”) , published the following documents on 17 June 2022:

1. FATF Statement on High-Risk Jurisdictions subject to a Call for Action

1.1 Since February 2020, in light of the COVID-19 pandemic, the FATF has paused the review process for countries in the list of high-risk jurisdictions subject to a Call for Action given that they are already subject to the FATF’s call for countermeasures. The FATF therefore asks member jurisdictions to refer to the Statement on High-Risk Jurisdictions adopted in February...

Details

INTERSHORES l Licensing Regime For Virtual Asset Service Providers (VASP) And Two-Tiers Registration For Dealers In Previous Metals And Stones (DPMS) In Hong Kong, Anti-Money Laundering And Counter-Terrorist Financing (Amendment) Bill 2022

A new licensing regime for virtual asset service providers (VASPs) will come into effect on 1 March 2023 under proposed amendments to the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) (the AMLO) which were introduced to Hong Kong’s Legislative Council on 6 July 2022. The proposed amendments are set out in the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Bill 2022 (Amendment Bill) which also introduce a new registration regime for dealers in special metals and stones (DPMS) an objective to impose statutory anti-money laundering and counter-terrorist financing (AML/CTF) obligations on these two sectors.

In the Amendment Bill,

1. Any...

Details

INTERSHORES l 35% Additional Buyer’s Stamp Duty (ABSD) on Residential Property Transfer In Singapore Is Imposed

Singapore's Ministry of Finance has imposed a 35% additional buyer's stamp duty (ADSB) on top of buyer’s stamp duty (BSD) on any transfer of residential property into a living trust occurred on/after 9 May 2022.

This considers as a crackdown on HNW individuals who use opaque structures.

As a concession, a trustee may apply to Inland Revenue Authority of Singapore (IRAS) within 6 months after the instrument is executed for a refund of ABSD (Trust), provided that the following conditions are met:

1. All beneficial owners of the residential property are identifiable individuals;

2. Beneficial ownership of the residential property has vested in all of these beneficial...

Details

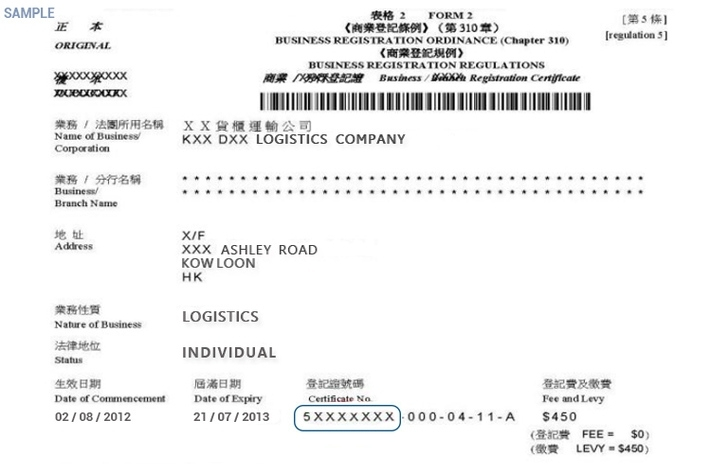

INTERSHORES I Waiver Of Business Registration Fees For One (1) Year (From 1 April 2022 to 31 March 2023)

The Hong Kong financial secretary proposed in his 2022-23 Budget to waive business registration fee for one year, starting from 1 April 2022. Under the proposal, the fees payable in respect of business registration certificates and branch registration certificates that commence on or after 1 April 2022 but before 1 April 2023 will be reduced by a sum of HK$2000 and HK$73 respectively. Taking into account of the proposal, the Business Registration Office has not demanded the registration fee for the above period in the renewal certificate and demand note for the business or branch. The levy of HK$250 remains payable.

Whatsapp : (852) 6499 4686

Phone : (852) 2186 6936

Email :...

Details

INTERSHORES I High Risk Jurisdictions And Jurisdictions Under Increased Monitoring 4 March 2022

The Financial Action Task Force (“FATF”), the global standard-setting body for anti-money laundering and combating the financing of terrorism (“AML/CFT”), published the following on 4 March 2022:

1. FATF Statement on High-Risk Jurisdictions subject to a Call for Action

The FATF calls on its members and urges all jurisdictions,

i. to give special attention to business relationships and transactions with the DPRK, including DPRK companies, Financial Institutions and those acting on their behalves.

ii. to apply effective counter-measures, which we hereby do, and advise you to apply enhanced due diligence measures, including obtaining information on the...

Details

INTERSHORES i TCSP Licensing, CDD & Record Keeping Requirements for DNFBPs

A licensing regime for trust or company service providers (“TCSPs”) in Hong Kong has been commenced with effect from 1 March 2018. Under the licensing regime, TCSPs are required to apply for a licence from the Registrar of Companies and satisfy a “fit-and-proper” test before they can provide trust or company services as a business in Hong Kong.

In addition, Designated Non-Financial Businesses and Professions (DNFBPs), including solicitors, accountants, real estate agents, and trust or company service providers ("TCSPs"), are required to observe statutory customer due diligence ("CDD") and record-keeping requirements as set out in Schedule 2 to the Anti-Money...

Details